Building A VPP – Successful Strategies for Market Entry

Virtual power plants (VPP) and battery opportunities is something thought about a lot at New Energy Ventures. It’s becoming increasingly clear that VPPs are likely to play a large part of the future grid.

The market opportunity for behind-the-meter energy storage over the next 10 – 20 years is going to be huge, with up to 180 Hornsdale Power Reserves worth of batteries to be deployed into the National Electricity Market (“NEM” – this covers Victoria, NSW, Queensland, South Australia and Tasmania). But this deployment will be competing toe-to-toe with grid-scale generation. If VPP builders want a large share of the pie, they’ll need to crack the business model first. Below we’ve laid out a go-to-market strategy, based on successful market entry strategies that some early bird businesses have deployed.

Regulatory and technical issues are something that many businesses have already tackled and overcome. The hardest part is selling batteries, virtual power plants, demand response and other technology as easily as, say, solar PV.

The complexity of integrating batteries and other distributed energy resources (DER) into the energy market makes developing a scalable viable business model a material challenge. Furthermore, these business models must be translated to customer offerings that customers can (a) get their heads around and (b) want to buy.

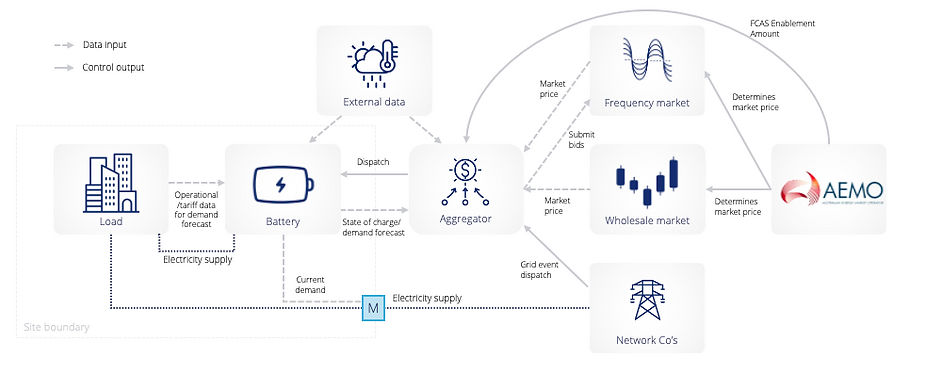

The diagram below is a good illustration of this complexity. It shows what’s required to integrate a battery into:

-

Frequency Markets

-

the Wholesale Market

-

Tap Grid support

-

and behind the meter value streams.

We have multiple stakeholders, complex technology, complex optimisation requirements and complex regulations to comply to. Somehow, either customers need to educate themselves on all this or vendors need to absorb the complexity and risk into their business model. As it’s an immature market, it’s no wonder investors are naturally pretty wary about this.

However, this also presents an opportunity for market participants to stand out: to absorb the risks, and simplify and streamline the market integration – and then reap the rewards.

The battleground between supply-side and demand-side businesses

There are two different types of businesses that are going after this opportunity – the traditional supply-side businesses (especially retailers and DNSPs) and the new energy technology vendors like battery companies and solar installers. But to be successful in this market you need an understanding of and access to the energy markets AND to be good at selling technology. Supply side businesses have historically really struggled to sell technology. Likewise, technology businesses have struggled to maintain sufficiently long investment to overcome the knowledge and compliance barriers for market participant.

The space is littered with failed businesses and product lines, but there are examples of successes – the stand-outs. In general, the stand out successes have been from:

-

Effective partnerships like that of Energy Locals and Tesla for their South Australian residential VPP

-

Acquisitions like that of Flow Power that acquired Beast Solutions, expanding its capability to do demand response

-

Incremental investments like that by ShineHub that we will discuss in more detail below

Figure 2 – Market participants targeting market integrated DER solutions. (NB: all the businesses highlighted in this graph are offering or attempting to offer a market-integrated DER solution. The parties selected are just for the purposes of illustration.)

ShineHub’s success is very instructive. In 2016, ShineHub started their business by just selling solar and battery systems to residential customers. In the first three years of their business they generated $15 million revenue from a seed of just $1000.

How did they do this?

-

First, ShineHub learnt how to sell solar and batteries, especially overcoming the sales barriers to batteries. 70% of ShineHub’s solar systems are sold with a battery as opposed to the market average of around 13%.

-

Then, ShineHub learnt how to operate and maintain a fleet of batteries. There were many teething issues for first generation batteries, including the Tesla Powerwall that was launched at about the same time ShineHub entered the market.

-

After ShineHub had a base of revenue and customers, they developed their own vendor agnostic, hardware-free virtual power plant software directly channelling into batteries to control them.

-

Finally, they developed relationships with networks and retailers to unlock the value of market integration. AusGrid now pay 45c/kWh during an event for participation of ShineHub’s customers in their VPP

Figure 3 – ShineHub case study – overcoming barriers to a virtual power plant

What’s important is ShineHub started with simple behind-the-meter solutions and learnt how to sell and maintain them before moving on to market integration. They also created a fleet of batteries that they could bolt their virtual power plant on top of. Simply put, the Minimum Viable Product (MVP) for a virtual power plant does not involve the market integration, it is simply selling a battery. They started with a simple self-sufficient battery value stack, and then added advanced value stacks onto it as they become available.

Applying residential battery learnings to the C&I market

As with residential batteries, C&I vendors can also ease into the market by targeting simple solutions before working up to more advanced market integration, greatly lowering company risk.

A simple C&I battery value stack of exclusively behind-the-meter services might include demand charge reduction, ToU arbitrage and (to a lesser extent) increasing solar self-consumption. In starting with this, a vendor can build a relationship and trust with a customer before (a) needing to have the VPP solution nutted out and (b) needing to sell the VPP solution to the customer.

Figure 4 – Simple and advance battery value stacks – key findings from NEVs whitepaper on batteries and VPP

Earlier this year New Energy Ventures released a white paper detailing modelling of 280 hypothetical C&I projects around the NEM. They considered the optimal battery size based on maximum Net Present Value (NPV) for batteries with simple and advanced value stacks. To do this they looked at 28 different commercial and industrial tariffs from around the NEM and looked at how they would apply to 5 different common C&I load profiles – a shopping centre, a quarry with a very peaky load, a batch run manufacturing facility, a university and a large apartment complex. They determined that 25% of tariffs in the NEM deliver positive NPV for batteries with simple value stacks. This is plenty of opportunity for businesses to cut their teeth on simple C&I batteries.

Then, after that a business that is capable of moving on to advanced battery value stacks that integrates energy market value front-of-the-meter will have a much bigger market to play in. 50% of tariffs in the NEM were determined to deliver positive NPVs. In their modelling, batteries with an advanced value stack are roughly around 3 times bigger and deliver a lot more value. This is a huge prize for vendors who can crack the market-integration business model.

So, where to start selling VPPs?

The easiest starting point for selling VPP’s is to use your available data to find and sell batteries into the best and lowest hanging opportunities in the market. Unfortunately, it this isn’t as simple as solar where nearly every solid unshaded roof is a valuable candidate. You’ll need to look at the interaction of the load profile, generation profile, tariff, network constraints and coincidence of market events and how the battery can capture value during every interval of every day. A product like Vippy will help you understand exactly where your best opportunities are.

In summary….

-

The market opportunity is significant, but the commercial barriers to it are the main issues today. Businesses that can address these barriers have a great prize waiting on the other side.

-

To participate in the market, you’ll need a solution that is strong both behind-the-meter and front-of-the-meter. This is going to be the critical challenge for most vendors trying their hand at VPP’s. Partnership, acquisition and careful increment are all pathways to success.

-

Start with the most important part of the journey – selling a simple technology solution to a customer. Without customers and assets in the field, the market-integration discussion is moot. For those that have data, use it to your advantage to find and convert the best opportunities.

New Energy Ventures is a specialist management consultancy and data-driven services provider that specialises in new energy technology and service models. Download their VPP Whitepaper to get even more insights into C&I battery and VPP opportunities. Or check out Vippy if you need battery and VPP modelling and/or sales support.

If you want to know more about this and other topics directly from end users of energy storage technologies join us at one of these annual events: The Energy Storage World Forum (Grid Scale Applications), or The Residential Energy Storage Forum, or one of our Training Courses.