How can energy storage projects be made bankable?

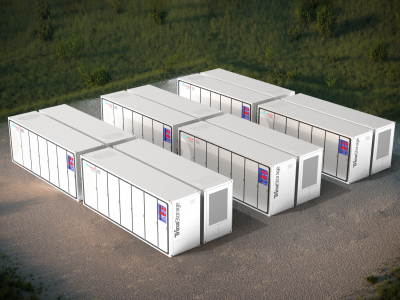

2017 has been a big year for energy storage projects — Aliso Canyon, California’s six month rapid-fire deployment of 100 MW of storage in response to gas leaks, Tesla’s record breaking big battery bet in South Australia. Utilities across the globe are commissioning more and larger energy storage installations, from backup power supplies in island locations like Nantucket to E.ON’s most recent large project in Texas.

These big projects have been making big waves — but big profits are proving trickier. UK battery energy storage investors Foresight calculate that battery storage costs need to fall a further 30% to be truly competitive. Forging ahead, energy storage developers have had to seek other ways to make their projects economically viable.

The Rocky Mountain Institute in their 2015 white paper “The Economics of Battery Energy Storage” identify 13 value drivers in the sector — but the fast-paced nature of new developments and rapidly falling costs of technology mean the figures are already out of date. So how are developers making bankable projects in practice?

Source: Rocky Mountain Institute The Economics of Battery Energy Storage (2015)

Solar developers SunRun in California have been seeing both profit and growth, using energy storage to add value to their rooftop solar systems. Anesco’s Clay Hill development in the UK, the first to forgo subsidies, also credits its success to energy storage. Leasing solar-plus-storage systems allows for both an ongoing income stream from consumer contracts and grid-balancing opportunities — Germany (SonnenFlat), Australia (GridCredits) and the UK (GridShare) are seeing promising early results.

Adding energy storage to existing generation sites (such as with Tesla’s South Australia installation) is another way to reduce overall costs. By taking advantage of existing transmission and distribution infrastructure, initial capital expenditure is reduced and revenue generating activities can start on an accelerated timeline.

Utilities are finding that the cost of energy storage is measured as much in what you don’t spend as what you do. Energy storage can be used to defer or avoid upgrading electrical transmission and distribution equipment (T&D deferral), as in the aforementioned Nantucket example. This value proposition is especially interesting for remote sites or emerging markets where reliable grid connections are not or cannot be established.

In terms of direct revenue, many energy storage projects rely heavily on government contracts. Firm frequency response (FFR), enhanced frequency response (EFR) and short-term operating reserve (STOR) contracts are lucrative sources of revenue in countries where they are tendered commercially, however the market is showing signs of saturation and the British government has directly warned developers not to rely too heavily on FFR/EFR revenue going forward. Case in point — this week’s shock announcement that the downgrade in de-rating factor will go into effect for Capacity Market auctions where prequalification has already taken place. Relying on arbitrage or peak-shaving alone does not make for a convincing business case.

Pressure from government regulations may also have an effect on the numbers. Official targets to increase energy storage capacity, such as those announced just this month in New York, put pressure on even more utilities to develop their own energy storage solutions.

We still have to wait for technology costs to fall enough to make energy storage projects bankable on their own. Current estimates think battery energy storage technology could be competitive as early as 2020. Until we reach that point, developers must continue finding innovative ways to combine energy storage with other applications or seek out value stacking opportunities to better make their business case.

Do you think 2020 is too optimistic considering current energy storage technology limitations? What companies do you think have the most innovative methods to stay profitable? Do you think governments and utilities should take more responsibility to prove the business case ahead of the commercial sector? Give your opinion at the Energy Storage World Forum Group on LinkedIn with our community of 12,000 members.

Further reading:

Follow The Money: Who Is Funding Energy Storage And Why

What Business Model Will Succeed in Energy Storage?

Maximising the value of electricity storage

AES Energy Storage Angamos Battery Energy Storage System (BESS)

If you want to know more about this and other topics directly from end users of energy storage technologies join us at one of these annual events: The Energy Storage World Forum (Grid Scale Applications), or The Residential Energy Storage Forum, or one of our Training Courses.