Non-Recourse financing for energy storage projects a possibility following landmark project

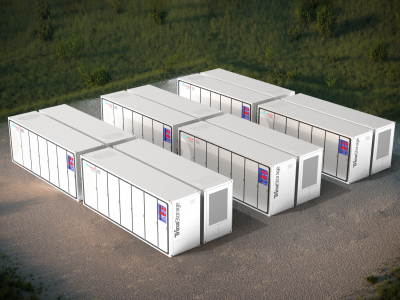

An Oregon-based energy storage developer has secured non-recourse construction financing for an 8.8-megawatt/40.8-megawatt-hour battery plant in Ontario – suggesting a sea change in direction for financing within this sector.

The investment from Brookfield Renewable Partners for the Powin Energy project is expected to change the face of investment as non-recourse funding becomes more attractive for those energy storage projects offering fixed revenue streams. Non-recourse finance, a loan where the lender is only entitled to repayment from the profits of the project the loan is funding, not from other assets of the borrower, is more usually seen in renewable energy markets but to date has been limited within the world of energy storage.

Geoffrey Brown, Powin Energy president, says, “Securing non-recourse financing is a critical step for energy storage assets themselves, as well as the broader market. Investor understanding of the technical side of battery storage has increased in recent years. Now it’s just about driving up the volume of projects. We don’t expect storage to be different to any other renewable energy.”

If you want to know more about this and other topics directly from end users of energy storage technologies join us at one of these annual events: The Energy Storage World Forum (Grid Scale Applications), or The Residential Energy Storage Forum, or one of our Training Courses.